What are carbon markets?

Carbon markets are mechanisms that enable governments and non-state actors to trade greenhouse gas emission credits through carbon pricing. The aim is to achieve climate targets and implement climate actions in a cost-effective manner.

There are two main types of carbon markets: compliance markets and voluntary markets.

In compliance markets, such as national or regional emissions trading schemes, participants act in response to obligations established by regulatory bodies.

In contrast, voluntary carbon markets allow participants to offset their emissions without any formal obligations. Here, non-state actors—such as companies, cities, or regions—voluntarily seek to achieve mitigation targets, such as climate neutrality or net-zero emissions.

International Carbon Market Standards

The 2024 UN Climate Change Conference, COP29, held in Baku, Azerbaijan, agreed International Carbon Market Standards for a centralised carbon market under the United Nations.

How do carbon markets work?

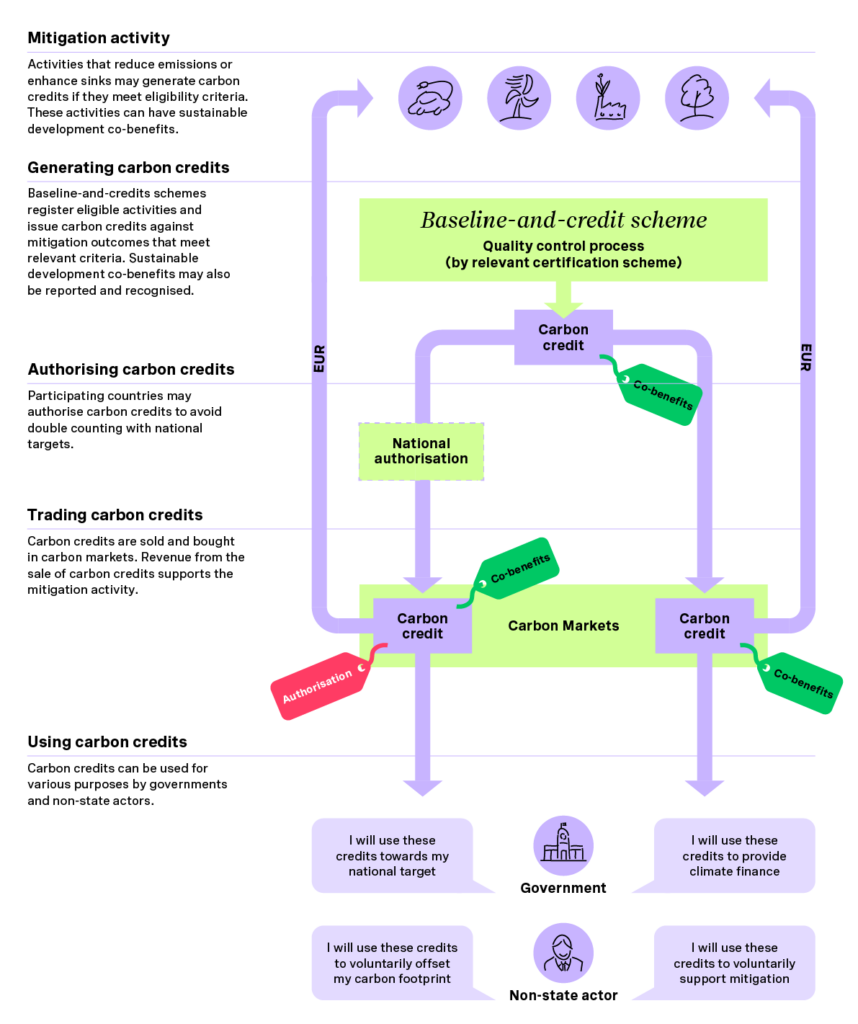

Carbon market cooperation mobilises the private sector in particular to identify and realise the most cost-effective additional mitigation opportunities, helping to make the most of limited resources. There are two main types of carbon market schemes:

Cap-and-trade schemes, which issue emissions allowances against a binding emissions cap

Baseline-and-credit schemes, which issue carbon credits against a conservative baseline for emissions reductions and/or removals that would not happen without the cooperation.

Carbon credits must also meet other criteria relating to, for example, methodologies, permanence and verification. There are numerous established baseline-and-credit schemes. Both types of units can be traded on carbon markets. Emissions allowances are mainly used for compliance purposes (cap-and-trade schemes). Some types of carbon credits are eligible for compliance use but can also be used for voluntary purposes, such as offsetting an organisation’s carbon footprint and delivering results-based climate finance.

Cooperation can and should benefit all partners and allow for higher ambition: the buyer supports mitigation activities in exchange for carbon credits, the host country and activity developer receive finance and sustainable development co-benefits, and all partners build their capacity for climate action.

Cooperation under the Paris Agreement

The Paris Agreement and the United Nations (UN) Agenda 2030 exemplify a global commitment to achieving a just and inclusive transition to low-carbon and sustainable societies. To meet these ambitious goals, international cooperation and engagement from the private sector are essential.

Market-based cooperation offers countries the opportunity to leverage the expertise and financial resources of private companies. However, to ensure that these carbon market initiatives effectively foster ambition and transformational change, it is crucial to establish robust rules and governance frameworks. The international community is now working together to implement these frameworks for carbon market cooperation under Article 6 of the Paris Agreement.

What is the Paris Agreement?

The Paris Agreement is a legally binding treaty adopted by 196 Parties at the UN Climate Change Conference (COP21) in Paris on December 12, 2015. Its primary goal is to limit the global average temperature increase to well below 2°C above pre-industrial levels, while pursuing efforts to restrict it to 1.5°C.

What is Article 6?

Article 6 of the Paris Agreement enables countries to voluntarily cooperate to meet their emission reduction targets in their Nationally Determined Contributions (NDCs). It allows for the transfer of carbon credits from reduced greenhouse gas (GHG) emissions, helping countries achieve their climate goals more effectively.

Carbon crediting mechanism cycle

Contact us